MAOF ST1-05 2011-2025 free printable template

Show details

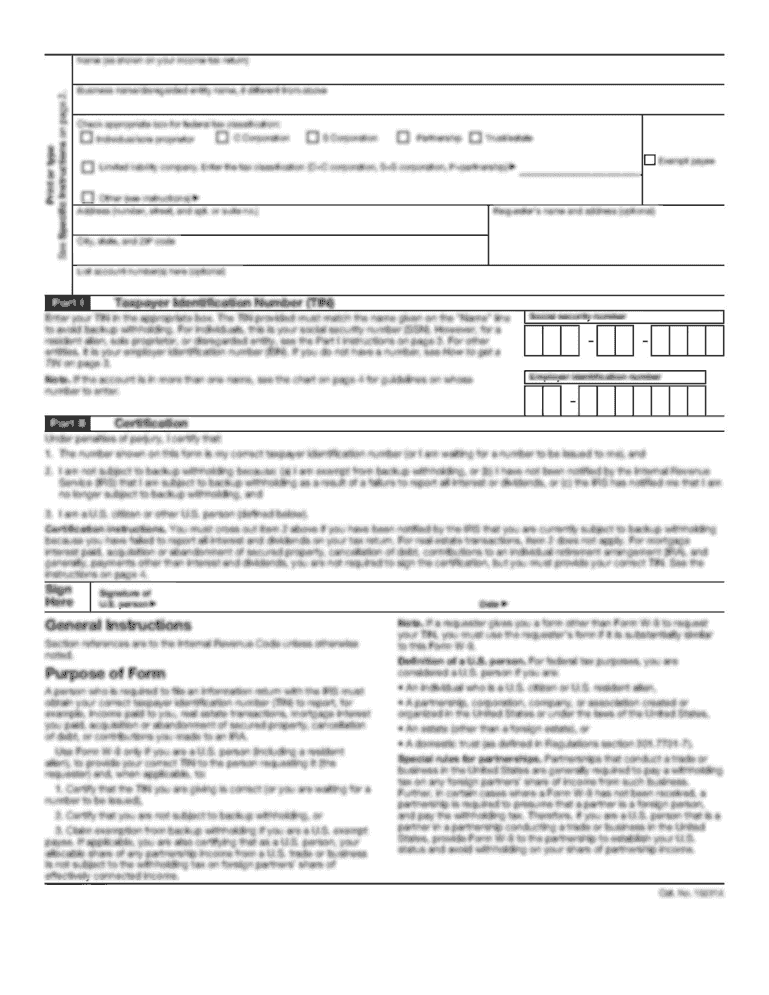

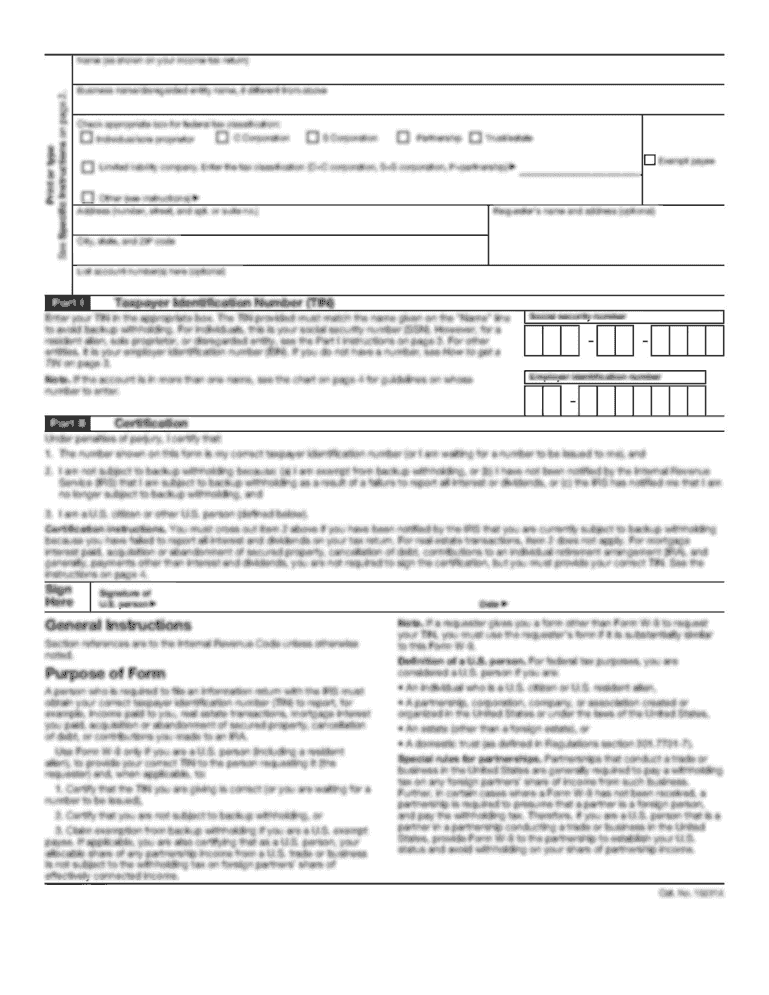

Participant s Signature ST1-05 Rev. 7/11 CalWORKs Stage 1 Child Care Participant-Provider Services Application Date Care Agency and you the selected provider must be determined eligible before any child care expenses can be Please make a copy for your files. CalWORKs Stage 1 Child Care Participant - Provider Services Application AGENCY NAME ADDRESS PHONE OFFICE USE ONLY 401 N* Garfield Ave Montebello CA 90640 ATTN This is an application for child care services. This application must be...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign maof application form

Edit your st1 05 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st1 05 application form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maof 05 download online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit st1 05 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st1 provider blank form

How to fill out MAOF ST1-05

01

Gather all necessary documents such as your ID and proof of income.

02

Start with the personal information section and fill in your full name, address, and contact details.

03

Provide your identification number and date of birth accurately.

04

Move to the employment section and fill in your current job title, employer details, and duration of employment.

05

Complete the financial information section by detailing your income sources and amounts.

06

Review the tax-related questions and fill them out based on your current tax status.

07

Include any additional information or explanation in the designated section if applicable.

08

Double-check all entries for accuracy and completeness before submitting the form.

Who needs MAOF ST1-05?

01

Individuals who are applying for certain financial assistance programs.

02

Residents who need to report their income for government assessments or benefits.

03

Those seeking certification of their financial status for loans or grants.

Fill

maof 05 create

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file st1 05?

The person or business entity that is required to file ST-1 Form 05 varies depending on the jurisdiction and the specific requirements of the form. Therefore, without more context or specific information, it is not possible to determine who is required to file this particular form.

What is the purpose of st1 05?

ST1 05 refers to the 5th statement in the ST1 curriculum or syllabus. Without further context, it is difficult to determine the exact purpose of ST1 05. Generally, ST1 curriculum refers to actuarial or statistical techniques, so the purpose of ST1 05 may be to educate or provide knowledge about a specific topic or technique related to actuarial science or statistics.

What information must be reported on st1 05?

ST1-05 is a specific form used for reporting employee wage information to the tax authorities. The information that must be reported on ST1-05 may vary depending on the jurisdiction. However, generally, the following information is typically required:

1. Employer information: The employer's legal name, address, and identification number.

2. Employee information: The employee's name, address, Social Security number or taxpayer identification number, and, in some cases, date of birth.

3. Wage and income information: The total wages, tips, and other compensation paid to the employee during the reporting period, including any income subject to income tax withholding.

4. Federal income tax withholding: The amount of federal income tax withheld from the employee's wages during the reporting period.

5. State income tax withholding: The amount of state income tax withheld from the employee's wages, if applicable.

6. Local income tax withholding: The amount of local income tax withheld from the employee's wages, if applicable.

7. Social Security tax withholding: The amount of Social Security tax withheld from the employee's wages.

8. Medicare tax withholding: The amount of Medicare tax withheld from the employee's wages.

9. Other deductions: Any other deductions taken from the employee's wages, such as retirement plan contributions or healthcare premiums.

10. Employer contributions: Any employer contributions made on behalf of the employee, such as to a retirement plan or health insurance premiums.

11. Reporting period: The start and end dates of the reporting period for which the wages are being reported.

12. Signature: The form may require the signature of the employer or authorized representative certifying that the reported information is true and accurate.

It is important to note that the specific requirements for ST1-05 and the information to be reported may vary based on the relevant tax laws and regulations of the jurisdiction where it is being filed. Therefore, it is always advisable to refer to the specific form instructions or consult with a tax professional to ensure compliance with the local regulations.

Where do I find maof st1 05?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific st1 provider fillable and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the st1 provider download in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your maof provider download.

How do I edit 2011 maof st1 services form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share maof provider template from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is MAOF ST1-05?

MAOF ST1-05 is a financial form used for reporting certain financial activities and obligations in compliance with regulatory requirements.

Who is required to file MAOF ST1-05?

Entities and individuals engaged in specific financial activities as defined by regulatory authorities are required to file MAOF ST1-05.

How to fill out MAOF ST1-05?

To fill out MAOF ST1-05, gather all necessary financial data, follow the provided instructions on the form, and ensure all sections are completed accurately before submission.

What is the purpose of MAOF ST1-05?

The purpose of MAOF ST1-05 is to ensure compliance with financial regulations and to provide transparency in reporting financial activities.

What information must be reported on MAOF ST1-05?

Information required on MAOF ST1-05 typically includes details about financial transactions, asset valuations, and other relevant financial data as specified by the regulatory body.

Fill out your MAOF ST1-05 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

st1 05 Now is not the form you're looking for?Search for another form here.

Keywords relevant to st1 05 illinois

Related to st1 05 mium

If you believe that this page should be taken down, please follow our DMCA take down process

here

.